With interest rates falling over the last few years you might have a great opportunity to save money on your home loan, pay off your loan sooner, get cash out from your property or consolidate debt. You can do this through refinancing.

Refinancing your home loan just means that you take out a new home loan to replace your old one. But why would you do this we hear you ask? There are a lot of really good reasons. Here are just a few:

With interest rates falling over the last few years you can sometimes refinance your home loan at a lower interest rate. This could make your home loan repayments lower. Or you could elect to keep your monthly repayments the same and pay off the loan sooner. This will mean you own your own home or investment property sooner. That’s got to be good!

If you’ve paid off a good portion of your home loan you may be able to use this equity for other things like a home renovation or anything else you can imagine.

You might have other types of loans like personal loans or credit cards. When you refinance you may be able to combine these debts with your home loan. This usually means a lower monthly interest bill because home loans generally have a lower interest rate than personal loans and credit cards. But remember, you’ll be paying these debts off over a longer period so you may pay more interest over time.

Sometimes lenders offer special discounts to new customers like cashback or lower interest rates. Refinancing to a new lender may let you enjoy these special perks but it’s important to understand the loans overall cost.

Switching to a different home loan lender may allow you to make extra repayments, access redraw facilities or use offset accounts. These features can help you pay off your loan sooner or better manage your repayments.

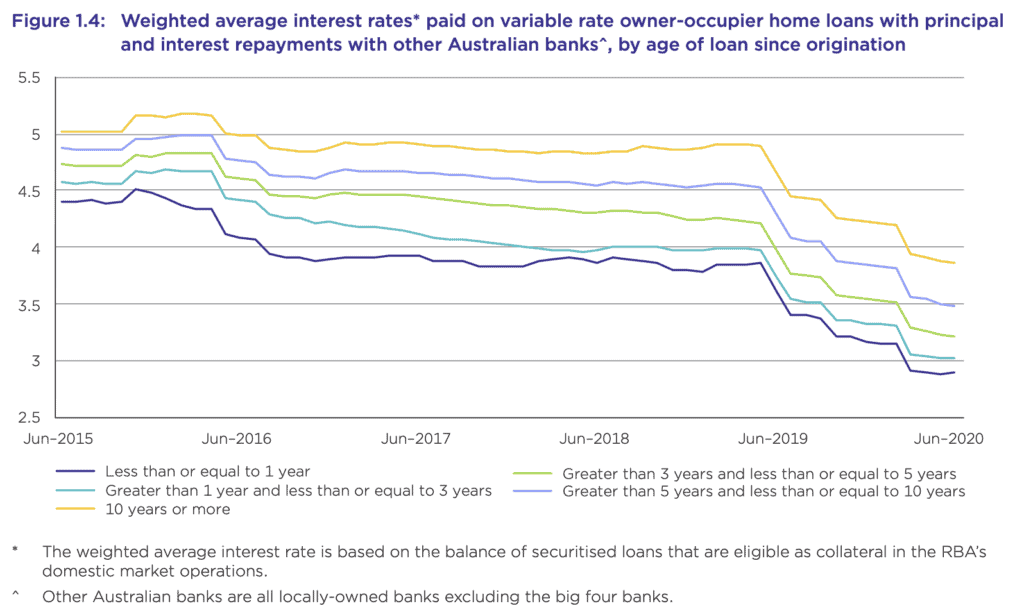

One of the key reasons to refinance we discussed above was to reduce your loan costs. The ACCC completed a home loan price inquiry and they found some really interesting facts that give an indication as to what you could save.

The ACCC found that the older a home loan the higher the interest rate. For example,

Borrowers with home loans between three and five years old were, on average, paying around 58 basis points above the average interest rate for new loans.

This meant that if a borrower with a home loan of $250,000 switched to a home loan with an interest rate 58 basis points lower than their existing loan, they would save over $1,400 in interest in the first year. Over the remaining term of the loan that borrower would save over $17,000 in interest in net present value terms.

Borrowers with larger home loans stand to save significantly more. For example, if a borrower with a home loan of $500,000 switched to a home loan with an interest rate 58 basis points lower than their existing loan, they would save over $2,800 in interest in the first year and over the remaining term of the loan that borrower would save over $34,000 in interest in net present value terms.

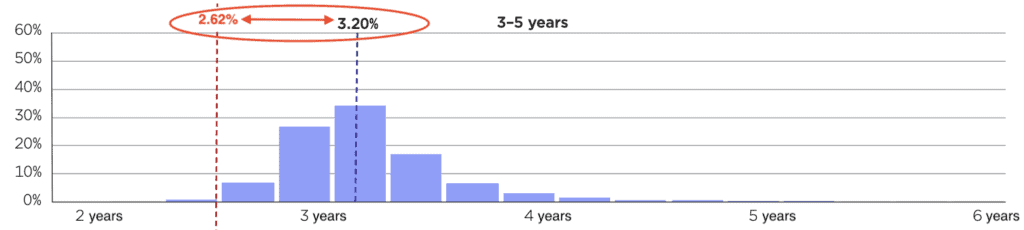

Here are the charts from the ACCC that clearly show the reduction of interest rates over the last few years and the impact it can have on a home loan.

The chart above shows that the average interest rate paid by borrowers with 3 – 5 year old loans was 3.20%. The current average is 2.62% – a massive 58 basis points lower (0.58%). Are you missing out on these savings?

As you can see, the ACCC have made it really clear what a big opportunity the recent reduction in interest rates can give to those with home loans.

If you’ve decided it’s worthwhile to find out if refinancing can save money on your home loan follow these steps:

Pull together key information like your current interest rate and monthly repayments, fees and charges, exit fees, how much equity you have and an estimate of how much the loan will cost over its lifetime.

It’s important to look at a lot of lenders and see what they offer in terms of interest rates, special offers like cashback, fees and charges, home loan features like offset accounts, additional repayments and redraw facilities. Remember, while a low rate is important, other things like fees and charges and loan features could impact your decision. After you’ve researched the market, compare what you find to your current home loan and determine if you can save money.

Once you’ve got a handle on some preferred lenders it’s worth talking to a few to see if you can negotiate an even better deal than they are publicly offering. Remember, the home loan market in Australia is competitive so lenders want your business.

We understand that this can sound a little complicated. That’s where Loan Comparison Genius can help. We take all the hassle out of this process and do all the hard work for you. We will check our panel of 27+ lenders and find a home loan that suits your circumstances. We’ll clearly show you a range of home loan options tailored to your situation so you can make an informed decision. You can start the process right now.

We also have a great article on how to compare home loans which is well worth the read.

While for many the goal is to save money, there may be some costs involved in refinancing your home loan. Don’t be discouraged by these fees. You just need to make sure that you are saving money in the long run despite needing to pay some upfront costs.

Some of the fees you may have to pay are as follows:

Discharge fees

You may be charged a fee to terminate your current home loan early from your current lender. This fee can vary but expect somewhere between $0 – $600.

Valuation fee

Your new home loan lender may want to value your property as part of the application process.

Upfront fees

Your new home loan lender may charge a setup fee for the new loan. Sometimes you can negotiate this.

Lenders Mortgage Insurance (LMI)

Lenders Mortgage Insurance (LMI) is a type of insurance that your lender takes out in case you do not pay back the loan. The borrower pays for this insurance. LMI usually applies to home loans with a deposit of less than 20%.

Again, before you refinance, add up to the total cost to change home loans and make sure that over the long run you are saving money. If you want us to do all the hard work for you simply follow these steps (no fee).

This is always a difficult question! On average we can work through the process in around 2 – 4 weeks depending on your situation and the lenders involved. Don’t be intimidated by the process. We really can make this simple and easy for you because we do this all the time!

Simply answer a few questions and we’ll be in contact. At Loan Comparison Genius we do all the hard work to find you a great loan for your circumstances from our panel of over 27+ lenders. Just sit back and relax!

Alright, this is really important and we think you will love it!

The government recently introduced awesome legislation called Best Interest Duty. The reason we think it’s awesome is that it means you can take comfort in knowing that we MUST act with the best interests of consumers. It also requires us to prioritise consumers’ interests when providing credit assistance.

This means that when you work with Loan Comparison Genius you will have peace of mind knowing that we are legally required to act in your best interests and put your interests first.

Here is an example of how this benefits you. As part of the process of working with us we will scan our panel of lenders and present more than 1 option for your situation. This will give you the opportunity to select the right loan option for your needs. All with the comfort of knowing we must act in your best interest. You cannot get fairer than that!

What’s really interesting is that this does NOT apply to banks because they only sell their own products. Those products may or may not be a good fit for you, but they can act in their own interest rather than yours. We don’t think you’ll like that.

In summary, we are on your side and the Best Interests Duty law ensures that. Start the process now to find a home loan that suits your needs.

Your personal circumstances and requirements are a really big factor when it comes to deciding which lender is the best to refinance your home loan. The interest rate being offered by a lender is clearly important but so too are the fees and charges, account features and other special offers. It’s really important to weigh this all up when considering a home loan. This all may seem complicated but we can make it really easy. Just start the process by answering a few simple questions.

Not at all but it’s really important to do a full analysis to work out if refinancing is the right move for you. Research the market and see what lenders are offering in terms of interest rates, special offers like cashback, fees and charges, home loan features like offset accounts, additional repayments and redraw facilities. While a low rate is important, other things like fees and charges and loan features could impact your decision. Once you have all this information compare what you find to your current home loan and determine if you can save money. Loan Comparison Genius can do all this for you. Just follow these steps to start the process.

When you take a new loan the lender will usually do a credit check. This credit check inquiry will be listed on your credit history. Because of this it’s best not to do a lot of credit checks because it could impact your credit score. This is why it’s smart to use a service like ours as we can assist the process and avoid multiple lenders doing credit checks.

Our expert services are free for most home and investment loans. We get paid by the lender for doing the work that would otherwise be done by a bank or lenders administration staff so you pay the same rate (or sometimes better) as if you went to the lender directly.

The Loan Comparison Genius key difference is that, unlike a bank, we can help you choose from a wide variety of lenders and get the best option for your needs from our panel of over 27 lenders.

We will only charge an administration fee for certain types of personal loans, business loans or short term loans. If you refinance or exit a home loan that we arrange within the first two years we may charge you a brokerage fee.

So, sit back and relax while we do all the hard work of finding you a great home loan for your situation from our panel of lenders.

Let’s face it - getting a housing loan is a big deal. It’s one of your biggest monthly expenses! If you shop around you can save serious money. However, shopping around can be confusing and time consuming. At Loan Comparison genius we take the pain out of getting a home loan. We do the hard work for you so you can skip hours of work when you apply online.

We’ll listen to your situation and find the best match for your personal circumstances from our panel of over 27+ lenders (from big banks, credit unions, building societies and specialist lenders).

Loan Comparison Genius is 100% privately Australian owned. We aren’t owned by the banks or other lenders so we are free to act in your best interests.

The loan to value ratio (LVR) is the amount you are borrowing for your home loan as a percentage of the lender’s valuation of the property you’re buying. For example, a bank may approve your loan for 75% of the property value – an LVR of 75% – in which case you would need to pay the remaining 25% as your deposit. So, if you wanted to buy a house that was valued at $400,000 a lender may approve you for an LVR of 75% which means they would lend you $300,000. In this case you would need to have a deposit of $100,000. Generally, a lender’s best mortgage rates are reserved for borrowers with a low LVR.

Lenders Mortgage Insurance (LMI) is a type of insurance that your lender takes out in case you do not pay back the loan. The borrower pays for this insurance. LMI usually applies to home loans with a higher LVR (more than 80%).

It only takes 10 minutes to kickstart the process. Includes a FREE no obligation consultation with a certified Genius.

Our geniuses go to work to find the right deal for your situation from a panel of over 27 lenders. All without hurting your credit rating.

We’ll present 3 great options and help you chose your preferred lender with complete transparency of rates and fee’s.

Sign the loan documents and buy that dream house (or refinance) knowing you've saved serious money on your home loan.

We'll find a great deal from over 27+ lenders (from big banks to building societies, credit unions and specialist lenders) which can save you serious money on your home loan.

We combine cutting edge technology with our experienced team to find you the lowest possible rate for your circumstances

Applying for a loan won’t impact your credit score until you are ready to proceed

All lender fees and charges are fully disclosed upfront so you know exactly what it’s going to cost.

We’ve built a simple, easy and secure online system to fast track your loan request

We can help accelerate the approval process so you get into that dream home fast.

Our geniuses will provide you with advice that’s free of the shackles of big bank ownership.

We are legally obligated to act in your best interests and put you first. Banks don't need to do this.

We get a buzz from our happy clients

Loan Comparison Genius is the business name of Loan Comparison Genius Pty Ltd (ABN 17 719 332 325). Credit Representative number 528539 is authorised under Australian Credit Licence 384704. Disclaimer statement: Your full financial situation will need to be reviewed prior to offer or acceptance of any offer or product. We promise we will never sell your email address to any third party or send you nasty spam.

Loan Comparison Genius is a proudly, privately owned, Australian business. Our goal is to help Australians find the right loan for their circumstances and make the process fast and easy. Although we compare many products from over 27 lenders we don’t cover the whole market or compare all features and there may be other products, features or options available to you.

Made with love in Melbourne Australia. © 2023. All rights reserved.